October 21, 2022

Americans Value Higher Education, but Differ on Student Debt Relief

More in Common US

Summary: While many Americans acknowledge the value of higher education, they are conflicted on how to manage rising student debt.

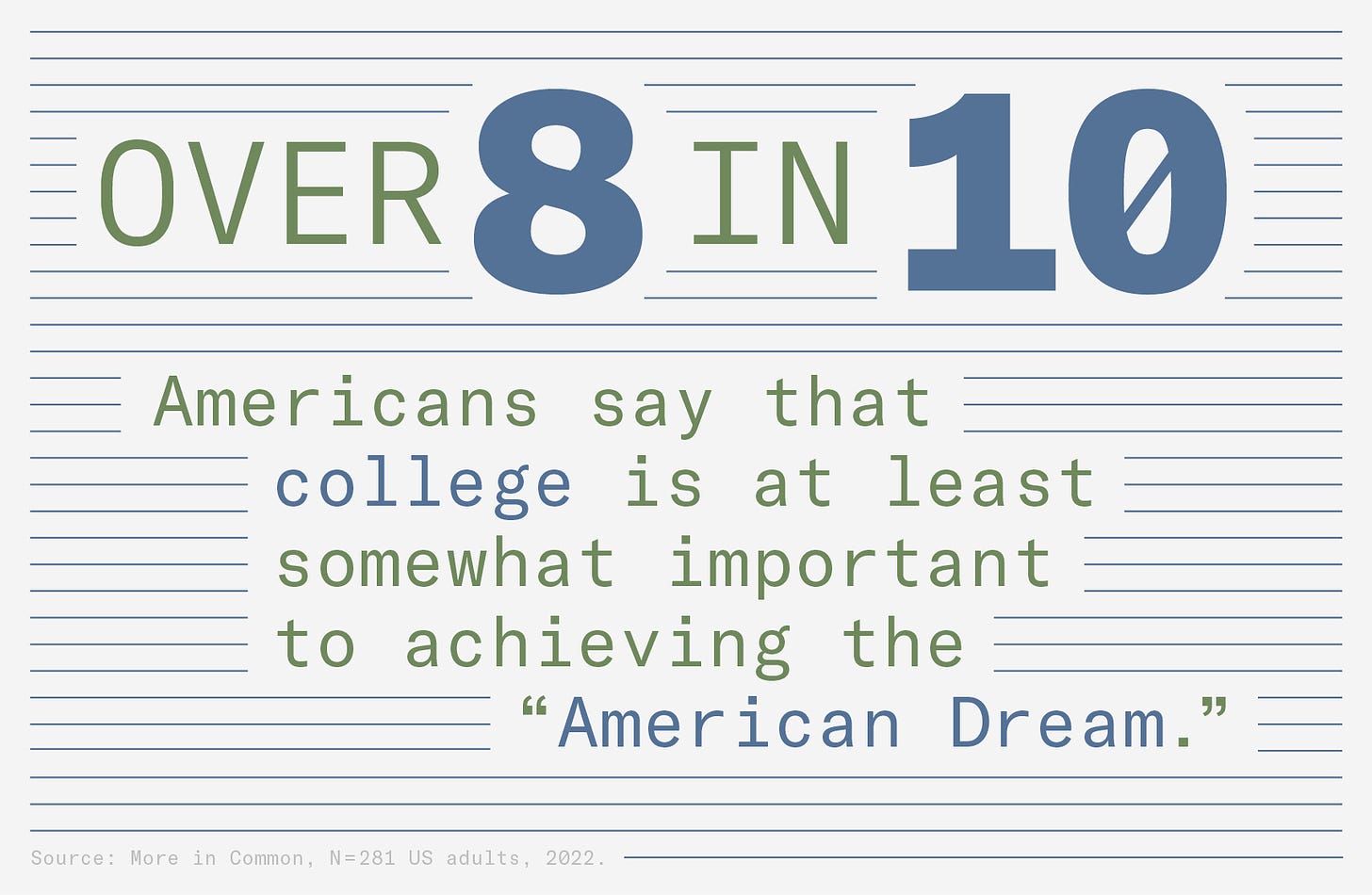

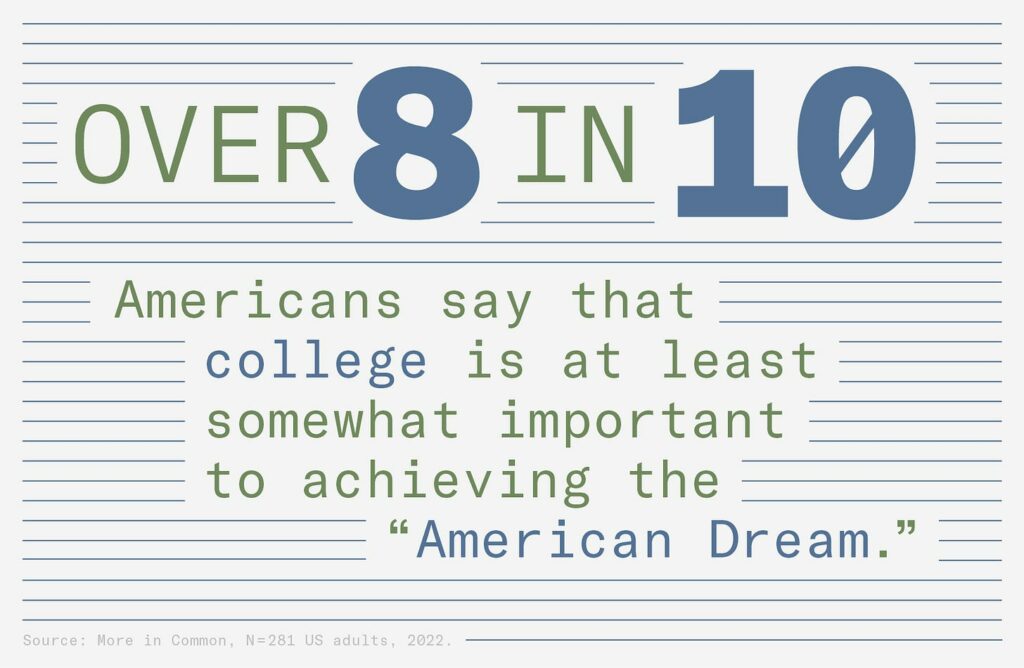

New research by More in Common found that most Americans believe that college is at least somewhat important to achieving the “American Dream” and that higher education should be available to anyone.

However, the average costs of tuition and fees have increased significantly in the last 20 years, making college out of reach for many or leaving those who do attend with potentially crippling student debt. Students of color are disproportionately affected, with Black college graduates owing an average of $25,000 more than their white peers.

In recent years, Republican and Democratic administrations have implemented various student loan relief policies ranging from pausing student loan payments to forgiving a portion of student debt. Do Americans support giving relief to student loan borrowers as a solution? When we asked our representative online panel of 280 Americans, we found: it depends.

Most American respondents think that college is somewhat or very important to achieving the “American Dream” and that finances shouldn’t be a barrier.

“The point of an education is to climb up the food chain and live a better life.”

💬 Xavier, Age 65+, Asian male, Disengaged, Wisconsin

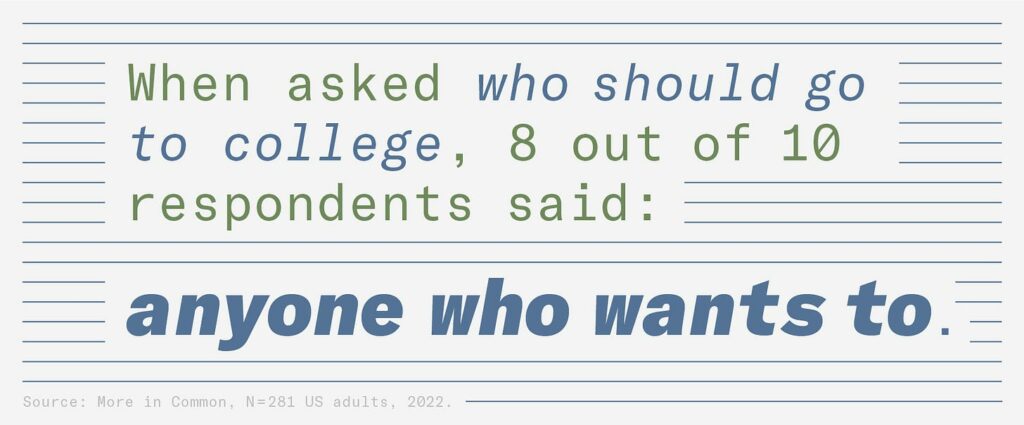

The majority of respondents, across party lines, agreed that personal finances should not be a barrier to college education: when asked who should go to college, 8 out of 10 said anyone who wants to.

“Education should be affordable because we are trying to better ourselves. We shouldn’t have to pay for it the rest of our lives.”

💬 Nancy, Age 45-54, Hispanic female, Moderate, California

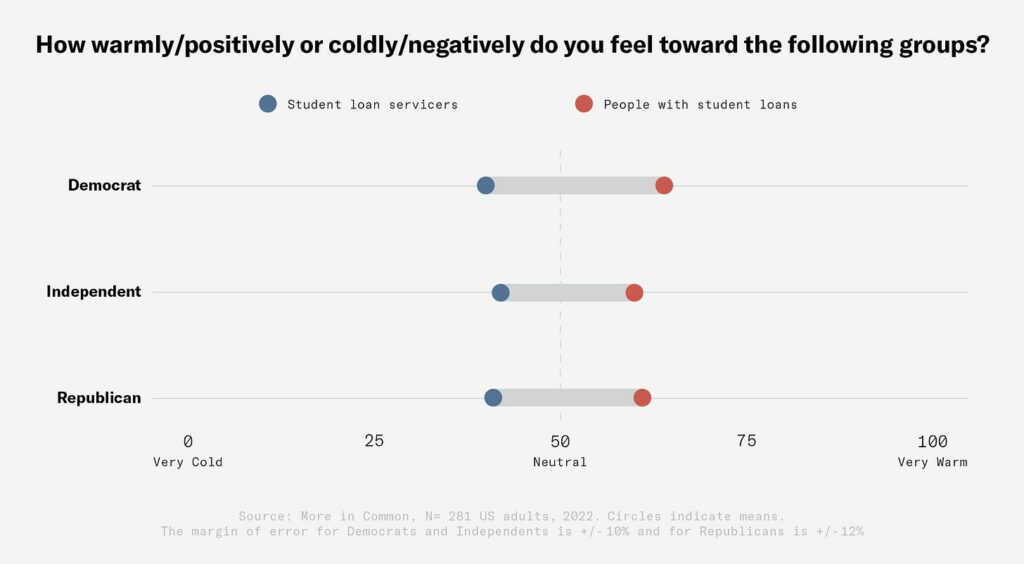

Respondents generally feel positively towards those with student loans and support the original pause in student loan payments during the COVID-19 pandemic.

7 out of 10 respondents support the policies that paused student loan payments during the pandemic (though a few also expressed the need to start repayment).

“It doesn’t affect me so I don’t care that much, but I think pausing them during COVID was beneficial. But that need is now over.”

💬 Marie, Age 35-44, White female, Traditional Conservative, Virginia

But, Americans don’t necessarily agree that debt forgiveness is the solution to providing student debt relief.

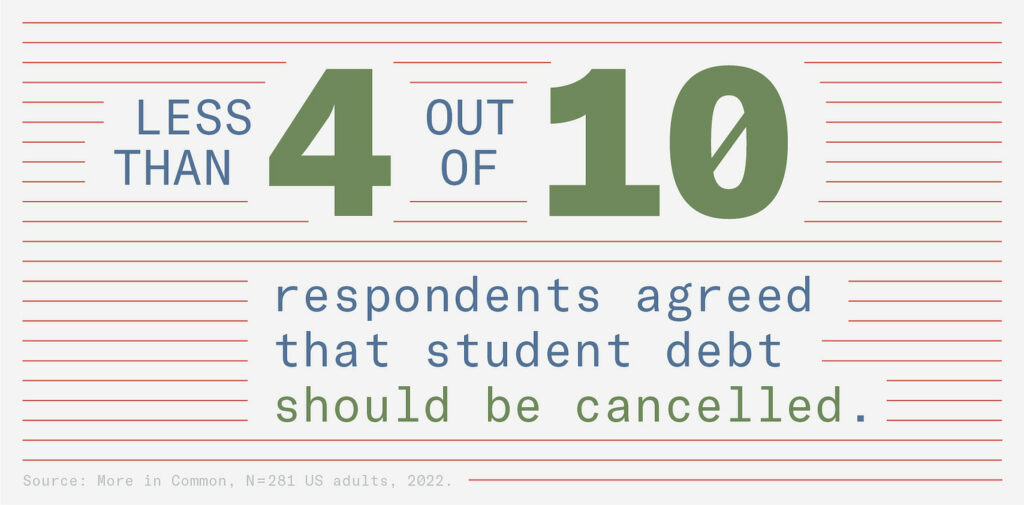

Less than 4 out of 10 respondents agreed that student debt should be cancelled. The Hidden Tribes were divided: Liberal Tribes wanted to cancel student debt, while Moderate, Politically Disengaged, and Conservative Tribes were opposed.

“There is no reason whatsoever that these loans should be cancelled, and it’s wildly unfair to people who worked hard and paid off their loans or paid for college another way. In my opinion, it’s so ludicrous that it’s hard to believe it’s real. What’s next, cancel mortgages? Cancel all responsibility for everything?”

💬 Jonah, Age 45-54, Hispanic male, Moderate, Texas

“I don’t think that people should be saddled with huge amounts of debt to gain the skills they need to be successful or to find employment. All education should be free from pre-school to university.”

💬 Norah, Age 45-54, White female, Progressive Activist, New York

Notably, personal experience with debt seemed to influence how respondents thought about debt relief, and, in some cases, potentially had a greater influence than even political affiliation on attitude formation.

“Education has vastly bloated and has not resulted in the 1:1 increased pay level that is indirectly promised. The cost of living has far exceeded what the starting incomes are, putting most people behind…[student debt] has been a burden my whole life.”

💬 Merle, Age 45-54, White male, Traditional Conservative, Idaho

“People incurred the debt knowingly and willingly. I have seen doctors who have the potential of making 300/400K complain about the 450K they owed [for school]. I paid for my college with an academic scholarship…anyone can.”

💬 Phillip, Age 65+, White male, Traditional Liberal, Alabama

“I had to pay mine back. They should as well, unless they perform some sort of civic work and get a reduction.”

💬 Donald, Age 45-54, Black male, Passive Liberal, Georgia

Key Takeaways

👉 The potential for college to lead to a more fulfilling job or higher wages has motivated generations of students to take on additional costs in order attend. However, in recent years, the rising expense of higher education has made such post-graduate benefits no longer seem possible. Nonetheless, our respondents generally still believe in the advantages of higher education and want it to be accessible.

👉 Opinions about how to help students with debt are influenced by more than just political affiliation: they are also influenced by individual experiences of student debt and ideas about personal responsibility. As Americans continue to debate the issue of student debt, we must consider how higher education, including its costs, has changed over time and recognize how lived experiences shape our unique perspectives on this issue.

👉 These insights can help us have more productive conversations about higher education by showing that most Americans are grappling and engaging with ideas of fairness, responsibility, and accessibility when thinking about how to create a better path towards the “American Dream.”

Thank you for reading the More in Common US Newsletter!

All statistics in this newsletter are from online survey interviews with N=281 adult US citizens from June 7th to June 15, 2022.

All quotes are from data collected between March and April 2022 from our online research community of 290 representative Americans. Names have been changed to protect privacy. Certain quotes have been lightly edited for brevity and grammar mistakes.